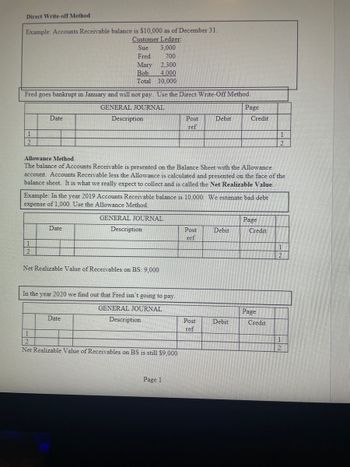

In the case of unhealthy debts, this implies estimating potential losses when the income is earned, not months later when a debt turns into clearly uncollectible. Understanding the causes of bad debt helps companies implement efficient credit insurance policies and collection strategies, minimizing the risk and influence of uncollectible accounts on their monetary health. The Direct Write-Off Method recognizes bad accounts as an expense when they’re judged to be uncollectible. It does not contain the use of the Allowance for Doubtful Accounts or any estimates. This technique violates the GAAP matching principle, as revenues and expenses usually are not recorded in the identical accounting interval.

Provide A Detailed, Step-by-step Instance Of The Way To Account For Bad Debt Using This Method

Selecting the best method for accounting for unhealthy debt is important for accurate monetary reporting and compliance with accounting standards. The Direct Write-Off Method is simpler however much less correct, as it doesn’t adhere to the matching precept and can lead to important fluctuations in reported earnings. On the opposite hand, the Allowance Method offers a extra correct picture of a company’s financial health by guaranteeing that bad debt bills are acknowledged in the same period because the related gross sales. It additionally complies with GAAP and IFRS, making it the popular methodology for many companies. The direct Write-Off methodology is a point of rivalry in financial evaluation because of its impression on the accuracy of economic statements.

From a tax perspective, solely the direct write-off methodology is accepted by the IRS for bad debt deductions, as it’s based mostly on actual losses rather than projections. This makes it notably suitable for small businesses or these utilizing money basis accounting. Bigger companies and public firms, which need to provide extra dependable and well timed monetary reporting, are extra probably to use the allowance methodology.

In contrast to the Direct Write Off, the Allowance Method offers an alternate method to account for bad debts. Not Like the Direct Write Off, the Allowance Method permits businesses to estimate the amount of dangerous debts and create a reserve, also called an allowance for uncertain accounts. Whereas the Direct Write Off Technique has its benefits, it additionally comes with some notable disadvantages.

For instance, writing off a large and materials account instantly won’t be proper. One buyer bought a bracelet for $100 a 12 months ago and Beth nonetheless hasn’t been capable of gather the payment. After attempting to contact the client several instances, Beth decides that she’s going to by no means receive her $100 and decides to write off the stability on the account. The direct write-off technique may not be the perfect resolution for each business, nevertheless it positively has its perks. For companies with largely reliable prospects, its simplicity and ease of use can make it an appealing option. When it’s clear a buyer just isn’t going to pay—due to attainable chapter, flat-out ghosting, or some other reason—you immediately write off the quantity of their debt.

It is extra suited for bigger companies with the sources to manage such forecasting. In distinction, the direct write-off methodology remains accessible to businesses that choose to address issues solely once they really happen. It’s simple to make use of https://www.simple-accounting.org/ and acknowledges unpaid money owed solely when they are deemed uncollectible. However, beneath the direct write off technique, the loss could additionally be recorded in a different accounting period than when the unique bill was posted. Grasp the fundamentals of economic accounting with our Accounting for Financial Analysts Course. This comprehensive program provides over sixteen hours of expert-led video tutorials, guiding you through the preparation and evaluation of revenue statements, stability sheets, and cash move statements.

The Allowance Methodology presents a extra realistic view of a company’s monetary well being by accounting for potential losses from uncollectible accounts. By adjusting accounts receivable for estimated bad debts, the steadiness sheet displays the online realizable value of receivables, providing stakeholders with a clearer understanding of what the company expects to gather. The Direct Write-Off Technique doesn’t adjust to Typically Accepted Accounting Rules (GAAP) as a end result of it violates the matching principle. GAAP requires that expenses be matched with the revenues they help generate throughout the similar accounting period. The Direct Write-Off Methodology, by recognizing bad debts only when they’re recognized as uncollectible, fails to match bills with the associated revenues. As a result, monetary statements prepared utilizing this technique may not provide a good and correct representation of a company’s monetary well being.

Journal Entries For Organising And Adjusting Allowances

By not accruing for anticipated losses, an organization can inflate its income in the quick term, only to take a significant hit when the unhealthy debts are eventually written off. This can lead to erratic earnings stories, which are less useful for analysis and may mislead buyers. The enterprise owners and the companies should be exact in writing off dangerous debts within the books of accounts as this impacts each the Balance Sheet and the Income assertion. Though the direct write-off technique is the simplest and easiest methodology to remove dangerous debt from the books of accounts, it should be used with prudence and warning.

The direct write-off method, while easy in its strategy, presents a significant challenge for financial analysis. This method, which includes expensing accounts receivable which are considered uncollectible directly to the earnings assertion, bypasses the allowance for doubtful accounts. While this will appear to be a simplification of accounting practices, it can distort the true monetary well being of a company.

- The two accounting methods used to deal with dangerous debt are the direct write-off methodology and the allowance method.

- Bad debt refers back to the amount of accounts receivable that a company considers uncollectible.

- According to IRS tips, businesses can solely deduct dangerous money owed on their tax returns in the event that they use the direct write-off method.

While stringent credit score insurance policies can effectively scale back the danger of unhealthy debts, overly restrictive credit phrases could inadvertently limit sales alternatives and erode buyer goodwill. To strike the best steadiness, companies should tailor credit score limits and cost phrases based mostly on individual buyer profiles, providing extra flexible preparations to those with robust cost histories. Typically, a customer may make a partial payment or negotiate a settlement for an quantity decrease than the unique invoice. If a partial cost is received, the business ought to cut back the Accounts Receivable balance by the amount paid and, if the remaining stability is deemed uncollectible, recognize it as unhealthy debt.

Regular evaluate of accounts receivable growing older stories is vital for figuring out problem accounts early and prioritizing collection efforts. When payments turn out to be overdue, having a structured collections process helps recover funds efficiently whereas sustaining customer relationships. Some businesses choose to mitigate credit score threat through exterior providers such as credit score insurance or factoring. Earlier Than granting credit, performing an in depth assessment of a customer’s creditworthiness is vital.